Your business's success depends on a huge number of factors, both inside and outside of your control. You can pour your efforts into building the strongest team, investing strategically in the right marketing channels, and cementing your reputation for reliability and value. But your company's growth also hinges on the reliability of the people you do business with: your clients and/or suppliers.

Can you be confident that your invoices will be paid as agreed or that materials you’ve ordered will appear on time? Unreliable payments – either from not getting payment for your services or from not being able to complete your job because of issues with your supply chain – can quickly disrupt your ability to manage your business.

It’s hard knowing that your cash flow can be at risk because someone else isn’t holding up their end of the agreement. But you can take control. Company credit checks can add a layer of protection to your bottom line. Services like CreditFocus make these available to small and medium businesses.

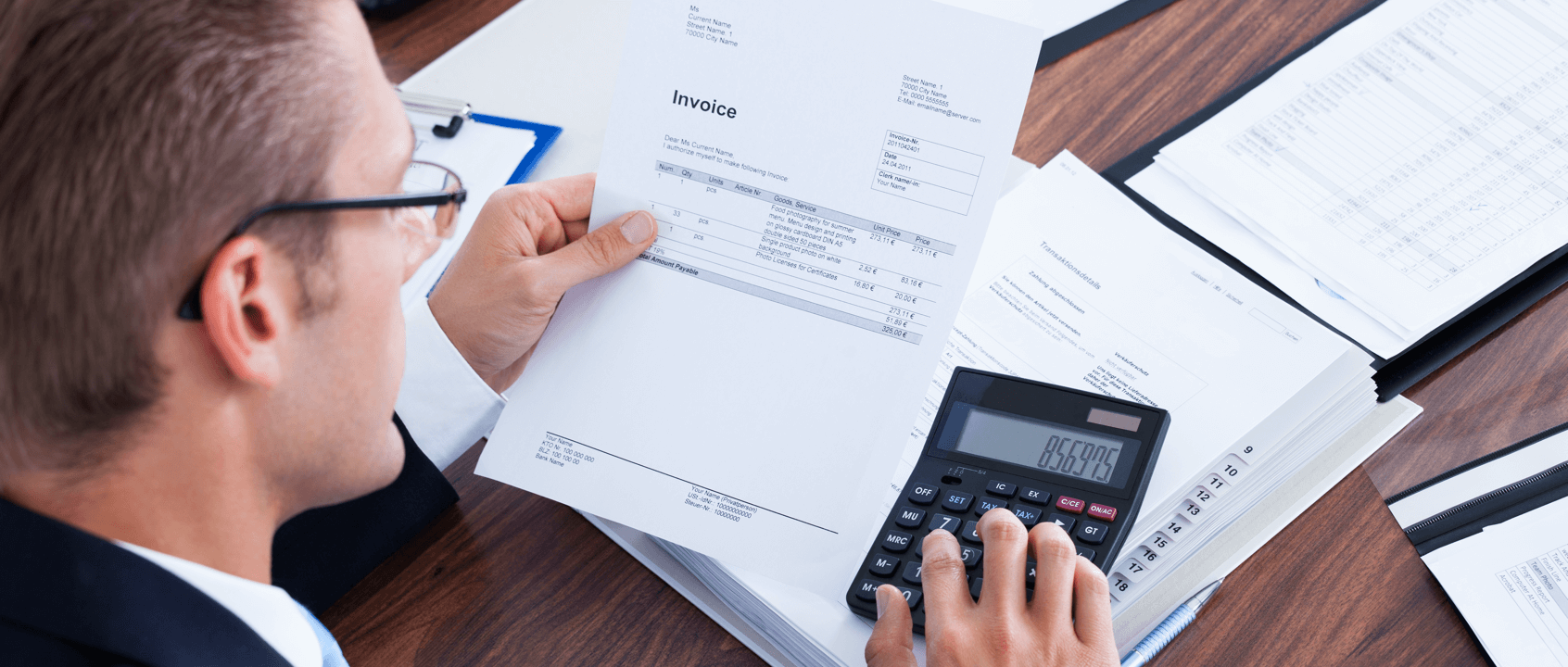

Unfortunately, a firm handshake doesn’t give you all the information you need. And a healthy relationship with your clients doesn’t just rest on agreeing on prices and timelines. To protect your business, you need to know that your invoices will be paid on time and delivered in full. That’s where a little prior research via company credit checks comes in using current and historic credit data to make data driven decisions.

It goes without saying that you should be careful to screen out risky clients. This is especially important if a large proportion of your revenue comes from a single client. If they aren’t able to make their payment, or make a habit of paying late, that can very quickly impact your ability to pay your own bills and even stay afloat.

Getting a hold of your prospective client’s business credit and payment indicator score through a company credit check gives you a window into how they manage their finances – and therefore how likely they are to pay you on time.

With CreditFocus it’s easy to see who you should avoid. It’s a service that generates an in-depth financial report on companies you’re on the brink of doing business with. This means you can then make an informed decision about the risk you run when you work with them, and – if you decide to go ahead – put some measures in place to help reduce or manage the risk of late or non-payment.

When you receive a CreditFocus company credit check report, you’ll get access to a range of helpful information, but probably one of the most important is the credit indicator score and the payment indicator score

They provide a ‘big picture’ snapshot of how credit-worthy a business is, or, put another way, how financially stable they appear to be.

The credit indicator score is calculated from a spread of both historic and current data, it comes as a score between 1 and 100.

The lower the score, the less trust-worthy the business. The higher the score, the better financial position the company is in – and the more likely it is that it will meet your payment. Ideally, your clients or suppliers would have a score of 80 or above and be officially low risk of defaulting on their payments.

The payment indicator score is calculated from both historic and current data and will show you how may days early, on time or late beyond agreed terms a customer will pay.

Low risk customers are signalled in green meaning they pay early or on time. Orange signifies they are medium risk and are likely to make payments up to 60 days later than agreed terms and red signals the customer is high risk, meaning the customer is likely to pay over 60 days late from the agreed terms.

CreditFocus uses up-to-date Experian data. You can find your client’s credit indicator score, payment score, information about the company’s directors, and whether they have any CCJs. Find out more about what a CreditFocus company credit check

Once you have the company credit rating you need, you can make an informed decision about whether to proceed with your client or not.

CreditFocus reports use an easy-to-digest traffic light system to let you know whether the company is a low, medium or high risk. You might decide that the CreditFocus report reveals that the potential risk of working with your prospective client is just too high.

When the results aren’t quite so black and white, however, you could use the information to decide new contract specifications to help protect your business. The traffic light system suggests what credit limit is appropriate for their risk level. Depending on what makes sense for your industry, you could also use this information to put different payment parameters in place, such as:

To help reduce the risk of late or non-payment, CreditFocus also assists with payment enforcement through payment chaser emails and solicitors’ final warning letters to make sure you are paid what you are owed.

As the saying goes, an ounce of prevention is worth a pound of cure. The best way to protect your business from unreliable clients is not to start working with them in the first place.

But things can change quickly after you’ve performed your company credit check. And you won’t necessarily know that a client is no longer is in a position to pay you until they’ve missed the payment date. Even a long term and loyal customer that you are on first name terms with is unlikely to tell you if they are having financial challenges.

CreditFocus continually monitors up to 50 businesses’ credit statuses and will alert you to any changes to their financial situation that could affect their ability to pay. Find out more about using CreditFocus’ credit monitoring

Through powerful, easy to digest company credit reports and your credit monitoring watchlist, identify how to improve your all-important business credit score and ensure every new…

View product nowWhen you’re on track to sign a contract with a new customer, it’s easy to only focus on…

Read moreIt’s crucial to stay up to date with your customers and suppliers credit status.

Read moreYou get recommended actions and easy-to-read, digestible business credit reports for businesses in the UK.

Read moreYou need to know whether your customers are financially stable and pay on time.

Read more